2026 Wage and Hour Compliance: What Employers Should Be Reviewing Right Now

One thing is clear so far this year: wage and hour litigation is not slowing down. In fact, disputes involving unpaid overtime, employee misclassification, and new restrictions on certain employment agreements are on the rise.

For employers, this means one thing - now is the time for a proactive compliance checkup. Wage and hour issues often hide in everyday practices, and small gaps can turn into expensive claims. Here are the key areas every employer should be reviewing this year.

Minimum Wage and Overtime Increases

The federal minimum wage has not changed in years, but many states and local jurisdictions continue to raise their rates. A large number of states have increases that took effect or will take effect in 2026, and some localities have even higher requirements or industry-specific rules.

Employers should confirm:

That all non-exempt employees are paid at least the highest applicable minimum wage

That tipped employee pay practices meet both cash wage and tip credit rules where allowed

That overtime is being calculated correctly based on the proper regular rate of pay

Relying on outdated wage tables or assuming federal rates apply can quickly lead to violations.

Exempt Employee Salary Thresholds

To treat employees as exempt from overtime under executive, administrative, or professional exemptions, employers must meet both a duties test and a minimum salary requirement.

Several states set salary thresholds that exceed the federal level, and some of those thresholds increased again in 2026. If an exempt employee’s salary falls below the required state minimum, the exemption may be lost - even if their job duties would otherwise qualify.

This is a critical time to review:

Salaries of all exempt employees

Whether job duties still align with the exemption being used

Whether any recent promotions or role changes have affected classification

Pay Rate Notices

Some states require employers to provide written notices to employees at hire and when pay rates change. These notices often include details about pay frequency, overtime rates, and allowances or credits.

Employers operating in multiple states should verify whether these notice requirements apply and ensure documentation is consistent and up to date.

Workplace Postings

Federal, state, and local laws require employers to display specific workplace posters covering wage and hour rights and other employment protections. These postings are updated periodically, and missing or outdated posters can be cited during investigations.

Employers should confirm that required posters are:

Current

Displayed in appropriate locations

Provided electronically where required for remote employees

Payroll and Timekeeping Records

Accurate recordkeeping is one of the strongest defenses in a wage and hour dispute. Federal law requires employers to maintain payroll and time records for non-exempt employees, and many states have even longer retention requirements.

Employers should review:

Timekeeping practices to ensure all hours worked are captured

Overtime calculations

Retention policies for payroll, tax, and time records for both current and former employees

Gaps in documentation often make it much harder to defend claims.

Independent Contractor Classification

Worker classification remains one of the most heavily litigated wage and hour issues. Employers are responsible for determining whether a worker qualifies as an independent contractor under federal and state laws.

Misclassification can result in liability for unpaid minimum wage, overtime, taxes, and benefits. It is not enough to rely on a contract label - the actual working relationship must support contractor status under the applicable legal tests.

This is the right time to review:

All current independent contractor relationships

The level of control the business exercises over their work

Whether the worker is truly operating an independent business

Job Descriptions, Job Postings, and Pay Transparency

Pay transparency laws continue to expand at the state and local level. These laws often require employers to include pay ranges or other compensation information in job postings and to share pay details with employees and applicants at certain stages.

Employers should ensure that:

Job descriptions accurately reflect the essential functions of the role

Pay practices align with what is communicated externally

Job postings meet applicable pay transparency requirements

Inaccurate or inconsistent information can create both compliance risk and employee relations issues.

“Stay or Pay” Agreement Restrictions

Some states are placing new limits on agreements that require workers to repay training or other costs if they leave before a certain period. For example, New York recently enacted a law that restricts the use of certain repayment provisions tied to continued employment.

Employers should review offer letters, training agreements, and other employment documents to ensure they do not include provisions that could now be considered unenforceable.

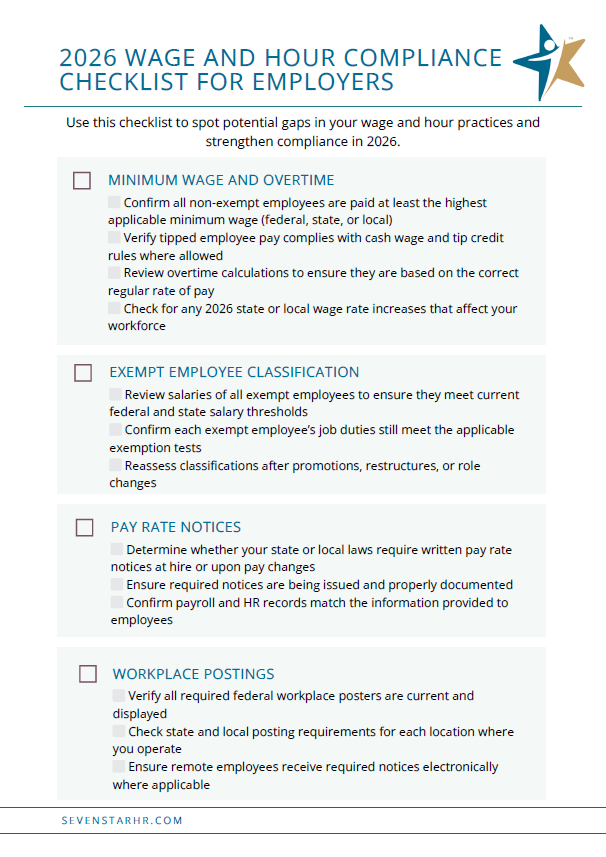

Download: 2026 Wage and Hour Compliance Checklist

To make this easier, we’ve created a free, printable Wage and Hour Compliance Checklist that walks you through each of these risk areas step by step.

Use it as a tool to help identify gaps before they turn into claims or audits.

A Proactive Approach Makes the Difference

Wage and hour compliance is not a one-time project - it’s an ongoing process. Laws change, pay practices evolve, and job roles shift over time. Without regular review, even well-intentioned employers can fall out of compliance.

This is exactly why we offer the HR MRI Assessment®.

Our complimentary HR MRI Assessment® is designed to give employers a clear picture of where compliance risks may be hiding - including wage and hour practices, classification decisions, documentation, and payroll processes. You’ll walk away with practical insights and prioritized next steps to help protect your business.

📞 877-923-0054

📧 info@sevenstarhr.com

If it’s been a while since you took a close look at your wage and hour practices, now is the time. Contact us to schedule your complimentary HR MRI Assessment® and make sure your 2026 compliance strategy is built on solid ground.